Amex Platinum Credit Card Review – Why it is the Impressive

All about Amex Platinum Credit Card Review:

Amex Platinum Credit Card Review: Credit cards (as we know them today) have been first introduced in 1958 in the USA by the Bank regarding America. The first outside the UNITED STATES OF AMERICA was the launch of Barclaycard in 1966 by Barclays bank. In 1967 any rival to the Bank regarding America System called Mastercharge was created. In the UK, the particular Access credit card was first launched in 1972 by a consortium in the other major UK financial institutions.

Amex Platinum Credit Card Review: The Bank of America and Barclaycard payment systems have progressed into the Visa network, although Mastercharge and the Access company have evolved into Master card. Any card issued in Britain today will usually include a Passport or MasterCard logo. American Express gives the particular exception being cards may only be used in establishments that will accept their cards. We have a fourth smaller network in the states called Discover.

All major financial institutions and some building societies in Great Britain offer cards to recent and new customers. Many give both Visa and Master card networks, and it is quite common to own one account with unique Visa and MasterCard memory cards.

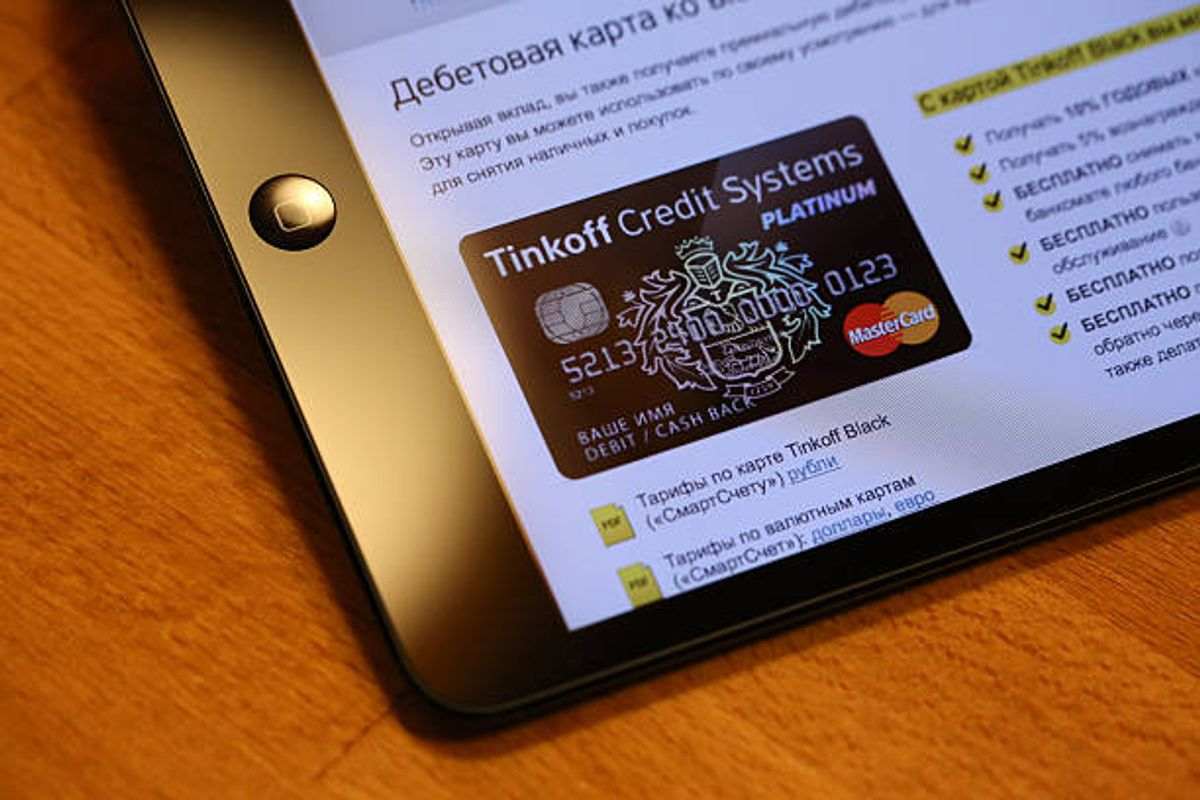

Amex Platinum Credit Card Review: In the 1980s, yellow metal and platinum cards were introduced to the market. Initially, we were looking at offers to customers who had an increased income. They often included a more extensive than the average credit limit. There was usually an annual fee installed on the card. A fee’s charging enabled the company to offer unique benefits, including free travel insurance to support and lower interest rates if your full balance was not repaid each month.

Amex Platinum Credit Card Review: Nowadays, the difference between a gold or gold card and a standard playing card has diminished. Simplistically, a new gold card will offer the purchaser a reduced interest rate and an extended interest-free period for just a balance transfer when compared to your regular menu. The gold card will show even better terminology than those available to a yellow metal card. Some gold and platinum cards give the case additional benefits, such as purchases through selected organizations. Most issuers have halted the practice of asking for an annual fee for the having of a gold or us platinum credit card.

Amex Platinum Credit Card Review: Applying for a rare metal or platinum credit card is not challenging. Generally, there are bare minimum income levels required, and naturally, a better than average credit score before a card will be issued to the customer. The particular minimum monthly repayment needs will generally be just like those of a standard credit card. Several issuers still offer lower price rates or other benefits for the gold and platinum bank cardholders, but this training is much less common than the days that they were 1st introduced. Often the initial borrowing limit is higher on a rare metal card than on a standard menu, and with us a platinum card, it can even be increased.